Get instant access to reliable business information and credit ratings in your Odoo system. Globally recognized and implemented by Rezolv.

Unique partnership, unique added value

The partnership between GraydonCreditsafe and Rezolv is no ordinary technical link. Graydon, the international reference for company data and creditworthiness, was looking for a reliable technology partner to make their information globally accessible in Odoo. That partner became Rezolv - based on proven technical expertise, reliability and customer focus.

Whether you already use Odoo, or are still with another partner: Graydon integration through Odoo is available to everyone. Activation can only be done through Rezolv, Graydon's official integration partner for this solution.

Who is GraydonCreditsafe?

GraydonCreditsafe is the gold standard in business intelligence, credit reports and risk management:

Part of the international Creditsafe Group

More than 430 million business reports available in 200 countries

110,000+ companies worldwide rely on their data

150 years of combined experience in business intelligence

Active in sectors such as finance, wholesale, manufacturing, logistics, construction and more

Companies choose GraydonCreditsafe because of its unique combination of local knowledge and international coverage. Their data is used daily for:

Credit reports

Financial screening and monitoring

Compliance checks (KYC, PEP, AML, UBOs)

Lead generation and marketing data

Automatic updates and monitoring

More about GraydonCreditsafe can be found on this page.

Why is business intelligence so important?

Especially as a wholesale or manufacturing company, you depend on your customers and suppliers.

What if your client can't pay?

How do you know if a new supplier is reliable?

Can you work compliantly without checking manually?

GraydonCreditsafe gives you real-time insight into the creditworthiness, financial health and compliance risks of every relationship; nationally and internationally. Quick decisions become easier, risks become manageable, your cash flow and margins improve.

Odoo + Graydon: this is how it works in practice

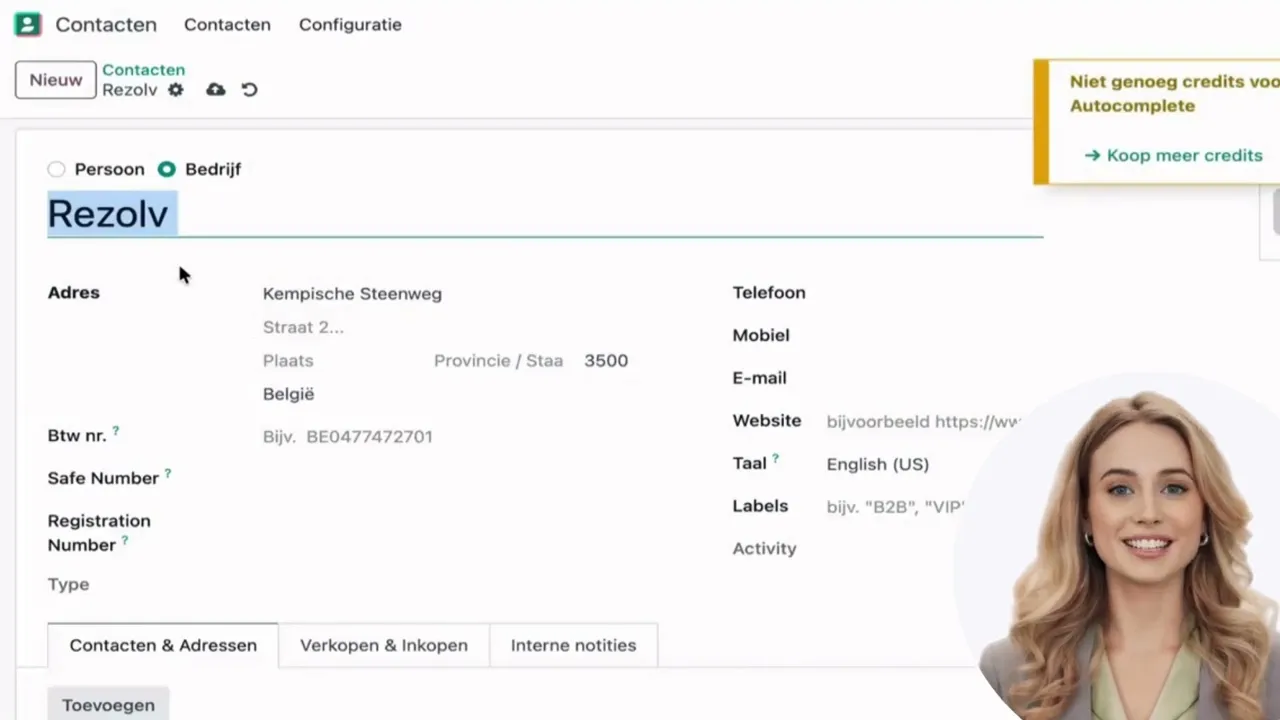

Rezolv built a direct API integration that makes all relevant Graydon data visible in Odoo:

Automatically search or add company data to new customers, suppliers or prospects

Instantly view credit reports, scoring, company structure and compliance information in one view

Get automatic notifications of changes in your relationships' financial situation

Use Graydon data as an extra check in your quotation or order flow

Manage all your compliance obligations (KYC, UBO, PEP, AML) without additional tools

Sample scenarios:

Order management: Your sales creates a new customer in Odoo - immediately credit score, business status and payment behavior are automatically retrieved.

Procurement: Checking suppliers for financial stability and compliance is done automatically through Odoo at creation or periodically.

Compliance: Automatic periodic checks for PEPs and sanction lists, so you're always in line with regulations.

Want to know how the module works in practice?

Take a look at the website of GraydonCreditsafe

Anyone with Odoo can start, even without Rezolv as a permanent partner

This integration is there for every Odoo user. Regardless of who did your Odoo implementation or who your current partner is:

Rezolv arranges the connection of GraydonCreditsafe to your existing Odoo environment

Fast live - often within days

No impact on your other Odoo functionalities

Also for multi-company and international environments

Why did GraydonCreditsafe choose Rezolv?

GraydonCreditsafe selected Rezolv as their official integration partner because of:

Deep Odoo knowledge, both technical and functional

Experience in complex environments and B2B integrations

Transparent, pragmatic approach and short lines of communication

Proven results at wholesale and manufacturing companies

People-oriented support and clear communication

This partnership gives you, as an Odoo user, the confidence that you are working with the best technology as well as a reliable party recognized by GraydonCreditsafe itself.

This is how applying and activating works

Contact: Request a no-obligation consultation or demo from Rezolv

Quickscan: Rezolv checks with you the technical possibilities within your Odoo environment

Integration: We activate the link for you. It is possible to provide training and guidance for commissioning.

Support: your updates are included - always an expert available

Use cases from practice

Wholesale: New customers automatically screened for creditworthiness and compliance

Manufacturing company: Suppliers monitored annually for financial health

International player: Through Creditsafe data also checked foreign partners

Construction industry: project-based checks from subcontractors and temporary partners

Ready to know more?

Want to see live how this unique integration works?

Request a free demo or get in touch with one of our specialists.

Rezolv provides hassle-free pairing, personalized advice and lasting benefits.

Also watch the official partner video on the Graydon website for a quick impression of the possibilities.

Rezolv: Digital transformation, pragmatic and people-oriented.